GST Doctor ITC Matching Software Pro Version

₹4,999.00

GST Doctor now supports BO Portal returns format. GST Doctor always updates to the latest version of returns. Purchase once and enjoy lifetime updates for just Rs. 4999/-

Category: Software

Description

GST Doctor Software

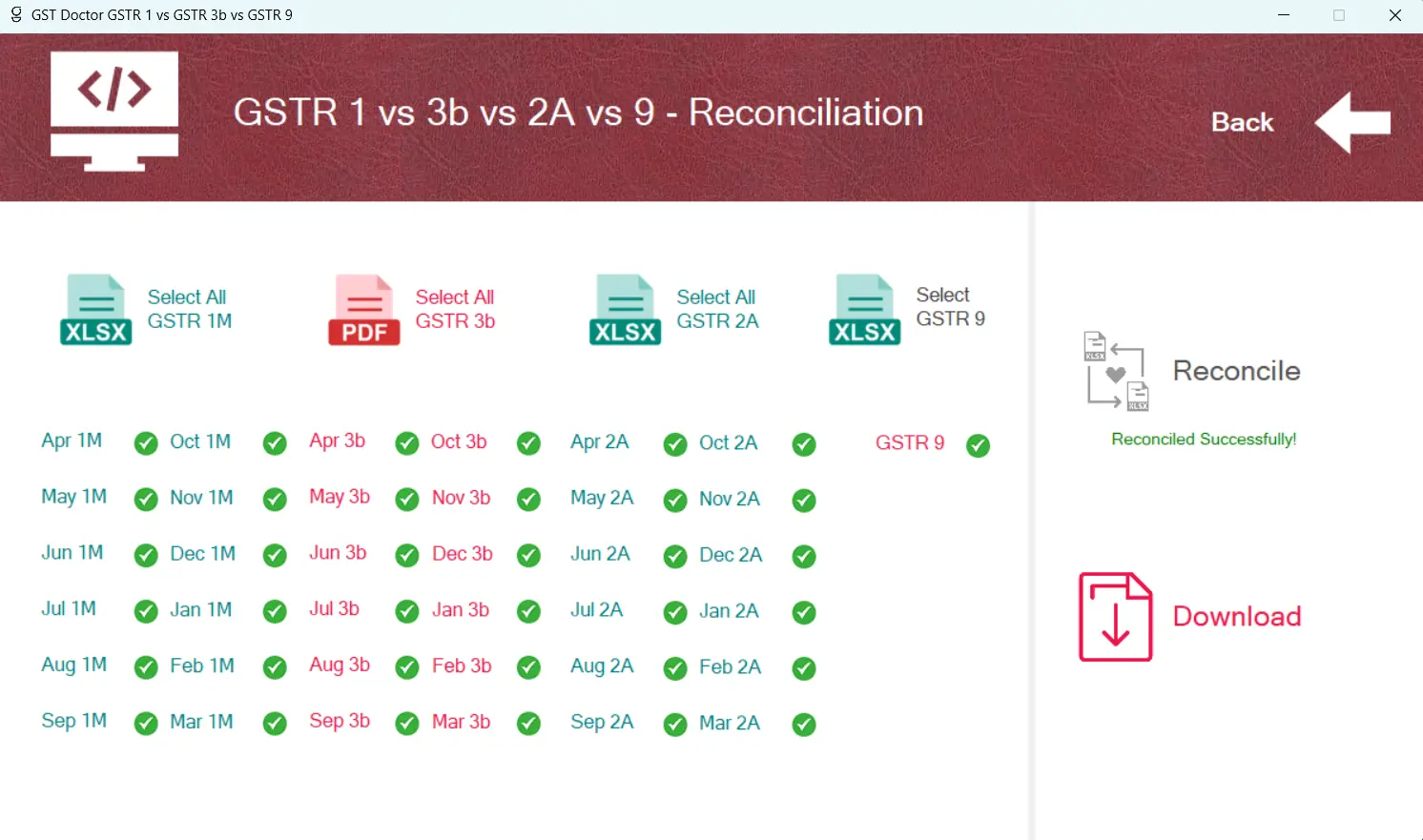

Every regular taxpayer with turnover above a certain limit files GSTR-1 and GSTR-3B every month and gets auto-populated GSTR-2A/2B. Some are also required to file GSTR-9.

- GSTR 1: Invoice wise Sales Data

- GSTR 2A: Invoice wise Purchase Data

- GSTR 3B: Summery of Sales and Purchase ITC

- GSTR 9: Final Annual Return with corrections

Software Features

| GST Doctor Software Features | Free Version | Pro Version |

|---|---|---|

| ITC Invoice-wise matching (upto 10000 Invoices) | ✓ | ✓ |

| Sheetwise GSTR-1 Consolidation | ✓ | ✓ |

| Detects GSTR-1 Invoices uploaded in wrong month (for interest) | ✓ | ✓ |

| Net Taxable Turnover (B2B+B2C+DN-CN) | ✓ | ✓ |

| Sheetwise GSTR-2A Consolidation (Taxpayer & Officer version) | ✓ | ✓ |

| Forward Charge and RCM Invoices in separate sheets | ✓ | ✓ |

| GSTR-3b Consolidation | ✓ | ✓ |

| Populate extended due date of 3b for that month | ✗ | ✓ |

| Auto-calculation of Interest based on correct due date | ✗ | ✓ |

| GSTR 1 vs 3b (Taxable and Non-taxable separately) | ✗ | ✓ |

| GSTR 1 vs 3b vs 2A vs 9 | ✗ | ✓ |

| ITC Invoice-wise matching (unlimited Invoices) | ✗ | ✓ |

For Instructions and other details about the GST Doctor Software click here.

Be the first to review “GST Doctor ITC Matching Software Pro Version” Cancel reply

Reviews

There are no reviews yet.